Annual Report 2013-14

年報

93

財務報表附註

(續)

Notes to the Financial Statements

(continued)

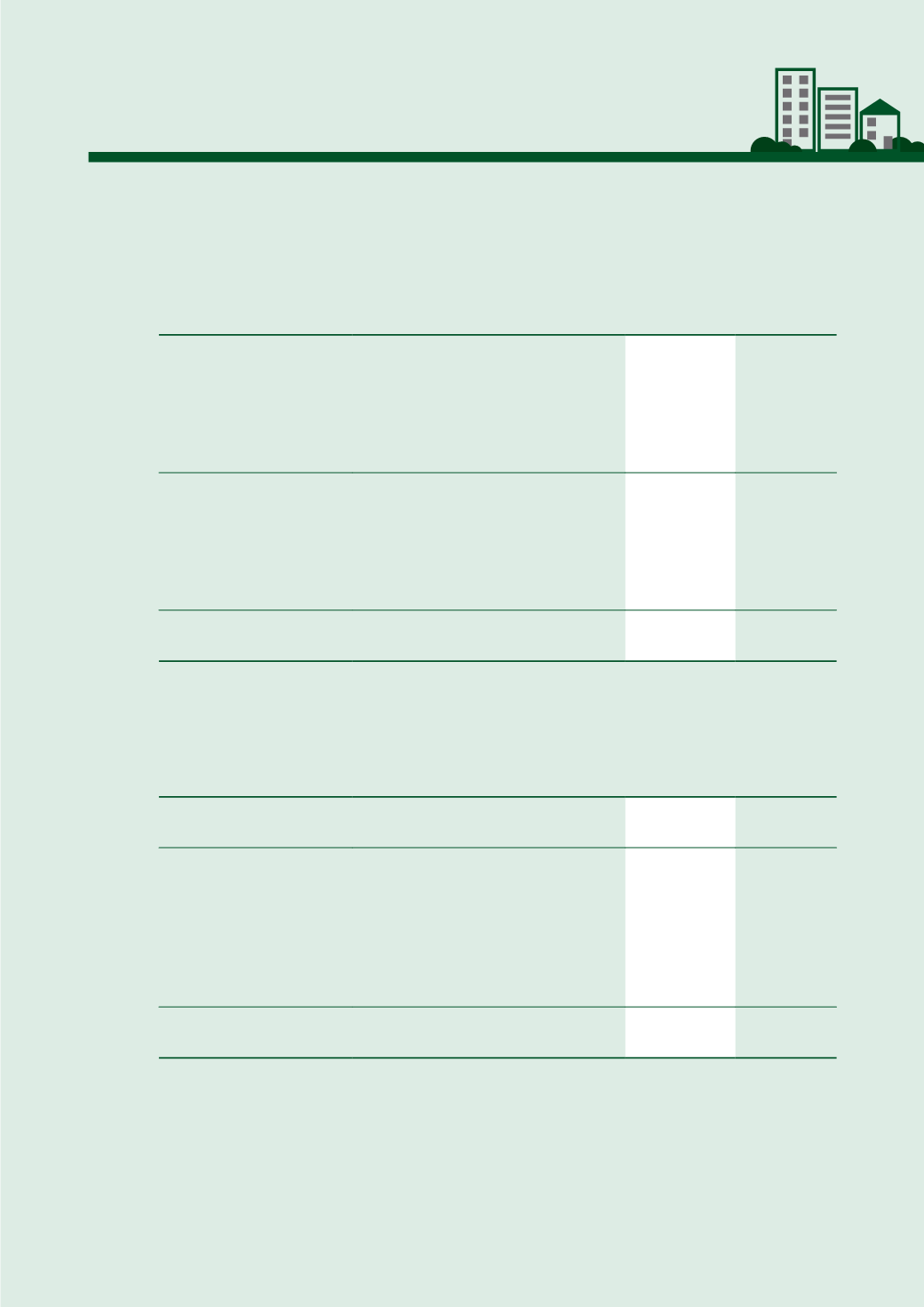

6.

名義利得稅

Notional profits tax

(i)

於全面收益表內扣除的名義利得稅如下:

The notional profits tax charged to the statement of comprehensive income represents:

2014

2013

本期稅項

Current tax

本年名義利得稅的

撥備

Provision for notional profits tax

for the year

16,275

30,475

上年度多提之撥備

Over-provision in respect of

last year

–

(12)

16,275

30,463

遞延稅項

Deferred tax

暫記差額的產生及

撥回

Origination and reversal of

temporary differences

(2,752)

(3,234)

名義利得稅

Notional profits tax

13,523

27,229

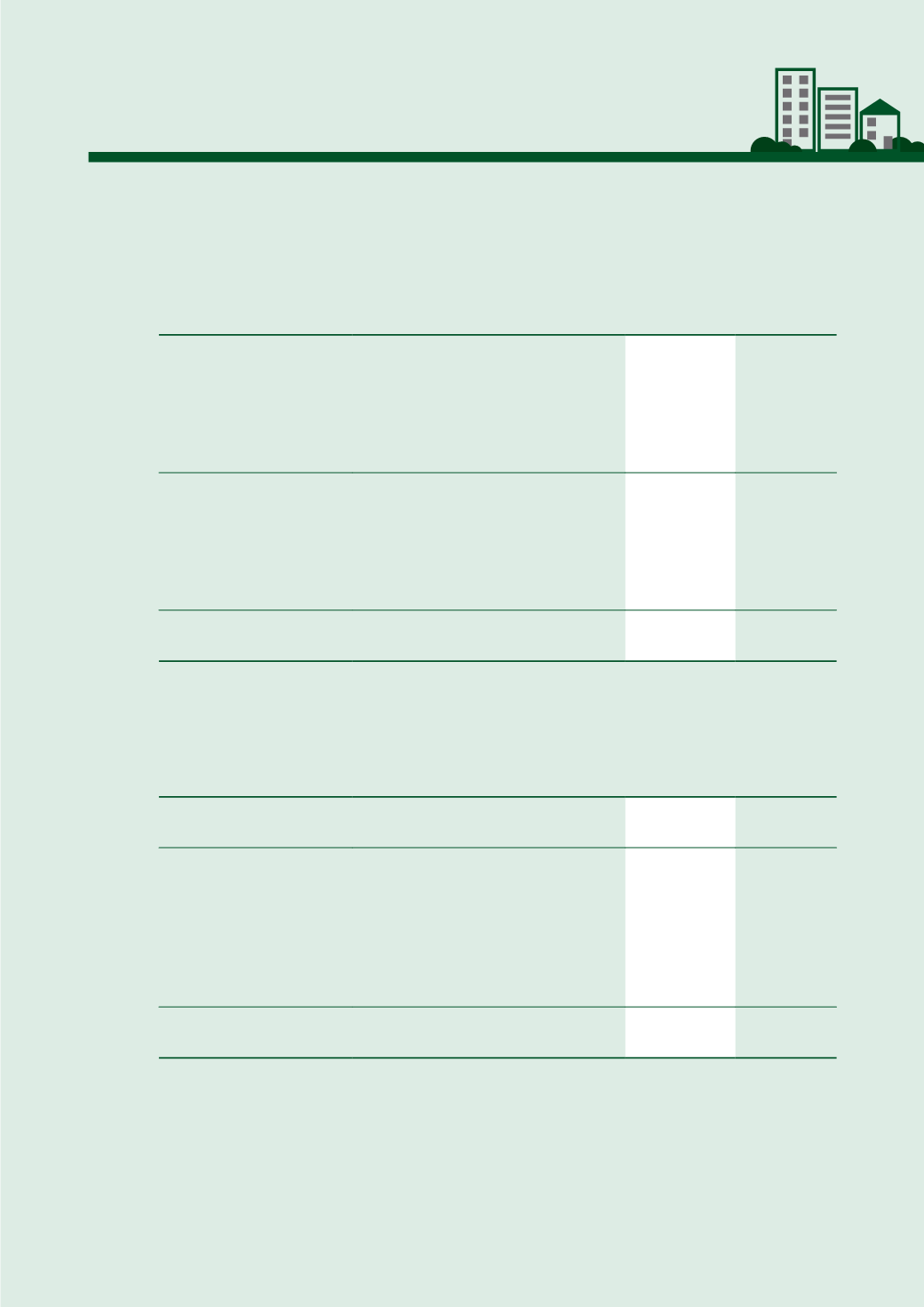

(ii)

稅項支出與會計盈利按適用稅率計算的稅項兩者之對帳如下:

The reconciliation between tax expense and accounting profit at applicable tax rates is as follows:

2014

2013

名義利得稅前盈利

Profit before notional profits tax

88,883

170,249

按香港利得稅率

16.5%

(二零一三年:

16.5%

)

計算的稅項

Tax at Hong Kong profits tax rate of

16.5% (2013: 16.5%)

14,665

28,091

一次性的稅項寛減

One-off tax reduction

(10)

(10)

非應課稅收入的稅項影響

Tax effect of non-taxable revenue

(1,132)

(840)

上年度多提之撥備

Over-provision in respect of last year

–

(12)

名義稅項支出

Notional tax expense

13,523

27,229